By Lacey Filipich BEng(Hons) MAICD Cert Gov (NFP)

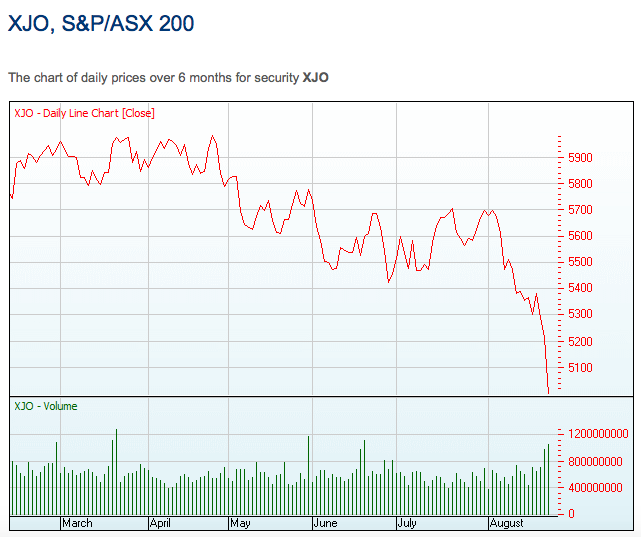

It’s official – China is not indestructible. The 8%+ growth machine has faltered, sending shock waves around the globe. In our own backyard, we’ve seen a sharp decline in the stock market then a small recovery (today anyway). The Australian dollar has plummeted causing widespread happiness for our nation’s export businesses, and my ASX Sharegame portfolio has gone to pot.

So is this the start of Global Financial Crisis version 2.0 (GFC v2.0), or just a to-be-expected blip in the heartbeat of finance?

And whatever the answer, what should investors be doing right now?

Before you get your hopes up: I don’t know the answer. No one really knows the answer – unless they own an as-yet unpublicised time machine. But just to stay in the spirit of the game, I’ll tell you what I’m guessing at the end of this post.

Doomsday specialists

Qualified experts declare ‘winter is coming’ daily with respect to finance. It’s just different experts on different days. This has been the case since there’s been a stock market to comment on, and people crying out ‘the sky is falling’ in the streets has been happening since there were streets to cry it in.

Just like a broken clock that shows the right time twice a day, it’s only a matter of statistical probability that they’ll eventually get their doomsday within coo-ee of their prediction. You can expect to see a LOT of commentary on GFC v2.0 in the media and plenty of people claiming they called it first.

And they may be right.

But we’ll only know that with hindsight. Till then, we’re just guessing.

Give me your best guess

With respect to financial markets and what they’re going to do tomorrow, next week and next decade, we can make an educated guess based on the facts at hand and what’s happened in the past, but that’s about it. It’s not much different to intently studying the form guide before placing your bet at the Melbourne Cup really.

With all this uncertainty, there are some things we can definitively say:

- Stock markets go up.

- Stock markets go down.

- Life goes on.

What we can know right now is that people holding a number of stocks in the ASX 200 will be feeling a bit glum. They’ve seen a large chunk of value dissipate from their portfolios almost overnight. Just this week my mother-in-law was lamenting the dent in her superannuation account’s value.

The stock market’s a real rollercoaster ride, and just like the rollercoasters at theme parks the fall is much faster than the climb to the top.

Given that we’re apparently on a downhill run at the moment, what would a sensible person do?

Go against the flow

Here’s what usually happens when stock prices drop:

- People panic.

- They sell their stocks at a discount.

- The media cries ‘Recession coming!’… or maybe even ‘Depression coming!’

- People panic some more.

- Prices drop further.

- The cycle repeats.

Stock prices dropping has real fear power – and rightly so. Some people rely on their stock values to keep themselves in the style to which they’ve become accustomed. Anyone relying on their share-heavy portfolio for superannuation payments will relate to this.

The trick is not to fall for the fear cycle.

If you own ASX 200 stocks right now, chances are they’ve lost some value compared with earlier this year. So what do you do? Your choices are simple: sell, or hold.

You might sell if:

- Your stop-loss is reached (then the sale will go through automatically).

- You think prices are going to drop further – in this case, you might sell then buy back the same stock at a cheaper price when you think prices are near the bottom.

You might hold if:

- You don’t think prices are going to drop further.

- You don’t care if prices drop further – you’re in it for the long run.

What if you don’t own stocks?

What should you do if you don’t hold any stocks, besides wiping your brow, saying ‘Phew’ and silently congratulating yourself on your foresight/lack of action?

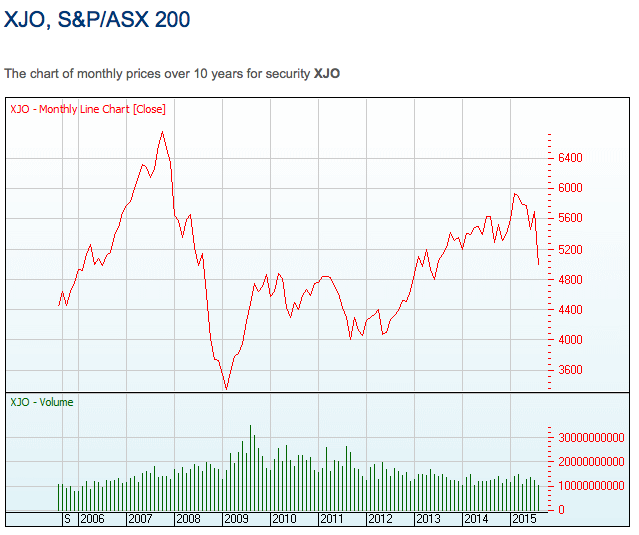

What goes up, must come down… and vice versa. Economies are cyclical, so if you’re like me (I sold out of my stock positions in early 2014) you’ll be rubbing your hands together with glee at the fire sale that’s on offer.

‘The way to make money is to buy

when blood is running in the streets.’

– John D Rockefeller.

The only important questions in this case are:

- How much money can you afford to invest?

- Have we hit the bottom yet?

I’ve been hoarding cash for over a year now. Now that Armageddon may be on the horizon, I’m putting a stop to all frivolous spending in an attempt to hoard some more. I’ve worked out how much I can redraw on my loans without impact, and worked out how much I need to keep aside as a buffer. Whatever’s not buffer will be getting invested in the stock market in some way, shape or form (perhaps some into an index, perhaps some into a blue-chip share with steady dividends… not entirely sure yet).

As to when: not sure yet either. All I know is I can’t pick the bottom. I’ll be waiting till the tide turns a bit. Sure, that means I’ll be forgoing some of the value I could have earned, but chances of me picking the turning point are slim-to-none. It may be a few days or weeks away, or perhaps a couple of years. Whenever it is, I’ll be poised, ready to pounce.

Placing my bet

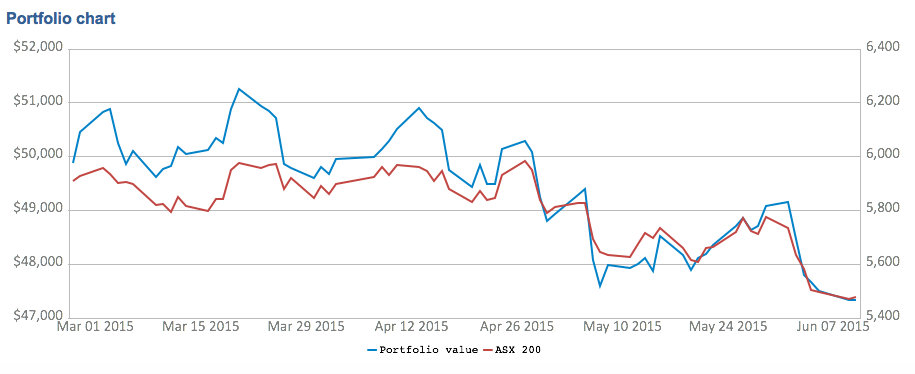

I don’t claim to be an expert on the economy. I’m not an ace share investor (check out my last ASX game portfolio results below if you don’t believe me). But because this is something of a game, I’m going to place my bet on what’s happening.

I think the GFC isn’t over.

Generally recessions means credit has to shrink – we need to pay back some of our debt and live with less. This hasn’t happened. Household and government debt have continued to grow since 2008. Hence, I reckon GFC hasn’t really finished with us. 2015 looks like the year that we will finally have to start reducing debt, triggering a deleveraging (or recession, or depression) and there will be some very unhappy people wandering around.

Whether I’m right or not, I won’t be miserable. If I’m wrong, I’ll find something sensible to invest my accumulated cash in and get steady, modest income and growth. If I’m right, I’ll be buying what I think are valuable assets at a significant discount. Either way, I’m a winner.

Just not at the ASX Sharemarket Game.

What comes next?

Download our Free Financial Resources

Find the right Money School Course for you

Get the Book: Money School, Become Financially Independent and Reclaim Your Life, Lacey Filipich

Got a question: Contact Us

Lacey Filipich is the co-founder and director of Money School. She helps parents raise financially savvy kids and helps adults get on top of their finances. Connect with her on LinkedIn and follow the Money School Facebook page to learn more.