I have a confession: I indulge in a form of gambling. It’s called short-term share trading.

It’s akin to a bout of binge drinking after nine months of abstinence while pregnant. Ill advised, and I like it.

Here’s why.

“Put it all on black!!!”… well, not quite.

“Honestly Officer, I’m usually very well behaved.”

95% of the time, I buy shares for the long haul.

I buy them because I think:

- the company is a good bet,

- the value of the share is likely to go up, and

- they’re likely to pay a dividend that beats bank interest.

I diversify. I buy index funds. I sign up to dividend reinvestment plans (DRPs) wherever possible. If there’s no DRP for a particular share, I quarantine that cash to include in my next share buy.

In short, I go for a low risk, low time commitment approach. It has historically delivered wealth for others. I play it ‘safe’.

Every now and then though, I indulge a guilty pleasure of mine with a bit more risk involved. I do it with small amounts of money, and I do what I can to reduce the risk, but still – it’s my form of gambling.

I buy and sell shares IN THE SAME YEAR.

Right now, those who already regularly trade are rolling their eyes. This is like someone whispering that they smoke a joint on their birthday to someone who injects heroin every day. Not exactly a big deal… for them.

But it is for me.

Is this regular trading a ‘gateway drug’? Will I move from fundamentals-based investment to day-trading hijinks? I expect not, but only time will tell.

I thought I’d share my little foray into the dare-devil zone, in case you’ve wondered how it works. In the interest of balance I’ve included a list of all the things that could have gone wrong but didn’t.

I’m not suggesting you do this, by the way. This is my attempt to sate the share-trading voyeur in you. Ideally, without you having to actually risk any money yourself.

Enjoy!

Financial advice and an adjustment

I first heard of this strategy a decade ago from my chiropractor.

No, I don’t take financial advice from health professionals, no matter how swanky their office. Actually they rarely give me financial advice anyway.

This chiro only disclosed this strategy when he learned I worked for the company he traded: BHP Billiton. It’s Australia’s largest mining company. It’s also (usually) the largest company on the Australian Stock Exchange (ASX). He was hoping I knew something about how the company was likely to perform. Being an engineer on one of the 100 operating sites, I wasn’t much use to him unfortunately.

But he was very useful to me. Not just because he managed to fix my hiatal hernia on the spot after I confounded a slew of doctors for a month.

(In case you’re wondering how: through extraordinarily painful external manipulation of my diaphragm. No, not that one, the one next to my lungs.)

The Strategy: Buy low, sell high.

Before you cry “Duh!”, hear me out.

The strategy he shared was something he’d taught his lovely younger wife. He worried she would struggle after he died. Not that he expected to die soon, he was planning ahead.

It was this:

- Buy BHP shares at a ‘low’ price (relatively speaking)

- Sell it when it reached a price $2 higher than the buy price

- Keep rolling the dividends and profits into the kitty

Over the course of a decade, the pair had ratcheted up some of their savings to $300,000 with this method. Each year, there were two to three buy and sell triggers they followed. They tended to earn 20% per year this way. She’d just keep rolling the $300,000 in and out of the trades. In theory, his wife could take the $60,000 profit to live on each year.

His reasoning was:

- BHP is the largest volume-traded share on the ASX – someone is always looking to buy or sell it.

- Its price fluctuates regularly – not necessarily in a wave pattern. But it’s generally bouncing up and down by a few bucks over the course of a month.

- If they bought too high, it was still a solid share they could hang on to until the price came back.

BHP’s share price for the last five years – lots of ups and downs

Intrigued, I proceeded to paper-trade his strategy. For eight years.

During this time, I sold the BHP shares I’d held as an employee around the $38.50 mark. This is something I was grateful for when the price went below $15 within 12 months.

…at which point I thought: ‘Gosh, that’s cheap!’

…and then I thought: ‘Maybe it’s time to actually do that buy low/sell high routine with actual cash?’

So I did.

Results so far

I decided to use $10,000 for my experiment. I’ve done the buy/sell routine three times since December 2015, a little under two years ago now.

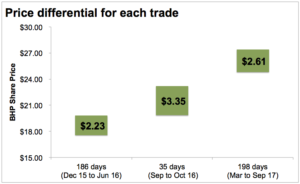

On the first occasion, I held the shares for 186 days and made 13.4% including one dividend payment.

On the second occasion, I held the shares for 35 days and made 16.3% on capital growth alone. I didn’t have them over a dividend payment period.

On the third occasion, I held the shares for 198 days and made 14.3%. This included two dividend payments, one of which hit my bank account today and prompted me to write this blog.

As I write this, BHP closed at $25.79. That’s $1.63, or 5.9%, less than I sold it for 11 days ago. Phew!

My three trades – what a relief!

Sounds pretty freaking good right now, doesn’t it. Foolproof you might say.

Wrong. Lots could have gone wrong, which is why this is like gambling.

What could go wrong?

Quite a bit actually:

- You could use money you need to survive, so you have to sell at a loss.

- The company could completely tank and you lose everything.

- You might forget to hold some of the profits aside to pay tax.

- You could buy at such a high price that it doesn’t go above that price for several months or years.

Here’s how I mitigate against these:

Forced to sell at a loss

Simple: don’t use money you can’t spare.

This is not an activity to undertake with your rent or food budget. It’s for money you’ve saved for investing, and over and above the lovely cushion of a buffer savings fund to see you through any unexpected upsets.

Company tanks, you lose everything

It happens. Rarely, thank goodness, but it does happen. (Remember Enron?)

Two things I like to do here:

- Buy shares in ‘reliable’ companies. I pick BHP because I know that industry and the company well, and I think it has good prospects. It pays reasonable dividends. It’s a company I’d be happy to have in my long-term portfolio.

- Use an alert or stop loss. You may like to have a price in mind at which you think ‘This is not going the right direction. I want to minimise my losses and get out now.’ You can do this with:

- a stop loss – a standing order to sell if the price drops to a certain point, or

- by getting an alert sent to your email or phone when it hits that price. Then you can put in a sell order manually if you want to.

There is a third option, which is literally options: buying an option to sell at the ‘get out now’ price. This is sometimes jokingly called an insurance policy and is not for the amateur, so I don’t do it.

You forget to set aside tax

In Australia, dividends and profits count as taxable income if you don’t hold the shares for at least 12 months.

Going off to buy a fancy car with all the proceeds of your sale? You might need to raid your savings, or go into debt, when tax time rolls around. Not advisable.

I like to put some extra cash into my buffer fund immediately following the sale until tax time. That way it’s there if I need it.

The price doesn’t go higher

Imagine if I’d started 12 months earlier at $38.50. I’d be feeling foolish right now. Which is why I waited till the price seemed cheap before my first buy at $17.57.

The buy price is very important.

Because of my familiarity with this company and industry, I was happy to hold on if the price kept dropping. I figured I’d still get a yield via the dividend. If I wanted to ramp that up, I could always sell covered calls (another form of options) to increase that yield. I’d just wait till it went up again, which I assumed was inevitable.

But only because I was buying so low.

I probably won’t do this same routine again until the price drops below $25 again. In my mind, that’s a reasonable price for BHP. Any higher and it begins to look overpriced – to me, anyway.

Vicarious pleasures

So, there you go. Now you know my version of gambling. I hope you’ve enjoyed reading about it and that vicarious pleasures are enough for you 😉

What comes next?

Download our Free Financial Resources

Find the right Money School Course for you

Get the Book: Money School, Become Financially Independent and Reclaim Your Life, Lacey Filipich

Got a question: Contact Us

Lacey Filipich is the co-founder and director of Money School. She helps parents raise financially savvy kids and helps adults get on top of their finances. Connect with her on LinkedIn and follow the Money School Facebook page to learn more.