By Lacey Filipich, BEng(Hons), MAICD

When I started saving half the income from my part-time jobs, I envisaged I would one day use the money to buy a flashy car. I dreamed of driving that car in the finest clothes, on my way to a swish restaurant. I had absolutely no expectation that my savings would be used to buy a property before I’d even finished my second year of university, but they did. I traded the flashy car, clothes and restaurant for a small, dingy apartment in which I wore clothes encrusted with paint and ate microwave dinners. I was 19 years old at the time. As usual, I have my mother to thank. My gratitude knows no bounds… seriously.

On 23 November 2001, I became the proud owner of a two-bedroom, one-bathroom apartment in Taringa, QLD. For those not familiar with Brisbane, Taringa is near the University of Queensland’s St Lucia campus. I paid $103,500 with a loan of $75,100 and no guarantors. A single bloke rented it for $120 a week, and it was hideous. When I finally took vacant possession of the apartment a month later and found myself enclosed in a brown box, my pride quickly evaporated. I cried. A lot.

I was living at home studying my second year of chemical engineering (which is a four year degree). I worked two jobs part-time: gymnastics coaching and after-school care. I was also doing the bookkeeping for my old high school’s uniform shop on a casual basis. I had just secured vacation work at BP Refinery at the whopping salary of $800 a week for the next 12 weeks.

How did I do it?

So how the heck did I convince the bank to loan me $75K for a run-down property as a student with no long-term employment, no assets besides my deposit, no credit history and no guarantor? An excellent question.

There were three contributing factors:

1. It was underpriced

The unit was listed for sale at $130k for a long time. The owner was keen to sell, so instead of hurling abuse at me when I offered a nearly 20% discount on that value, he signed. Imagine my shock! In retrospect, this was an excellent deal and I was very lucky. It was my first offer ever. Not for want of trying too – my mother and I had been looking at similar apartments every week for the last six months. The bank also knew a lot more about the property market than we did so perhaps they had an inkling that prices were set to double in the next year, which they did. Either way, this property must have looked like a pretty safe bet.

2. I had a lot of help

It is no stretch to say I couldn’t have done this by myself. It’s absolutely true. I relied on several people to get this done, the most notable of whom are:

Mum: it was her idea in the first place. I would never have dreamed it was possible until she started egging me on. She held my hand the whole way, through every home open, the contract negotiations, the mortgage application process. Everything. Without her support, I’d have been in the flashy car and still living under her roof. Hmmm, perhaps that was her motivation…

Dad: I give my dad a lot of crap for being bad with his money, but he was EXCELLENT with my money. He did the building inspection (for free, obviously) and haggled another $1,500 off the purchase price due to items needing work. He helped my transform the unit over the summer with my meagre budget of $6,000. His carefully planned renovations turned the unit from a brown box into a light, bright home that I loved. Without his help, I’d have cried myself to sleep every night. Dad also lined up a family friend who was a lawyer to act for me in the conveyancing (though not exactly cheaply, I now realize).

Mike: the boyfriend of a school-mate, Mike was a loans manager with Commonwealth Bank. He guided mum and me through the mortgage application process and got approval with amazing speed. He was so exceptional that he was my go-to guy for my next loan application in 2004, which he turned around in 48 hours. What a champ!

3. I made the application convincing

The mortgage application was make-or-break for this deal, and I know Mum lost more sleep over it than I did. There was some creativity required.

For instance, you may be wondering where a 19 year old gets $30k for a deposit. Here’s where:

- $8k came from savings from my part-time work from 14 years old.

- $7k came from an investment account in my name, in which all the cash gifts I’d received since I was a baby had been deposited.

- $15k came as an advance inheritance from my grandparents. My mother had to sign a letter explaining that it did not have to be repaid to avoid having to be a guarantor (which would have limited her borrowing capacity).

So it’s not all me. I was very lucky to have a supportive family who could find $15k to donate to a good cause. However, without showing how good I was at saving and my willingness to work my bum off to earn decent cash, they would not have been confident to make that investment.

As with most young people, my balance sheet was a bit bare. Beyond the money for the deposit, I didn’t have any cash. But I also didn’t have any debt that I needed to service right then – not even a credit card. I did have a student debt for my study costs (back then the scheme was called HECS) but it didn’t require any repayments until you earned above a threshold income. I was eligible for the First Home Owner’s Grant. Back then it was $7k for an established home and $15k for a new home (Queensland has since abolished the grant for established homes). This money was taken as a given even though I couldn’t get it till after settlement. It was listed as an asset and boosted my balance sheet.

As for cash flow: In June that year I became eligible for Youth Allowance through CentreLink, which would double to $192 a week when I left home. Because the apartment was my principle place of residence, it didn’t count in the means test. I also had the letter of offer for my vacation work with the salary of $800 a week to show as my income. I had the company word the letter very specifically so it appeared this was a long-term position (which it could very well have become… eventually). I’d had a taxable income above $10,000 the prior financial year, so I looked like a good bet for a 19 year old. Just as importantly, I lived like a student – my living costs were miniscule.

So the bank ticked its boxes:

- An undervalued property which they could sell at a price sufficient to recover the debt,

- Sufficient deposit to avoid the need for mortgage insurance, and

- Sufficient cash flow to service the debt without starving me.

Everyone was happy. At least, everyone but me until the renovations were completed.

What happened next?

For six weeks after I took possession of the apartment, I worked on weekdays at my vacation employer in Pinkenba then worked for three to six hours every weeknight and all weekend on the renovations. I had to apply filler to 50 square metres of tongue-and-groove ceiling (losing my fingerprints in the process) and it took four coats of paint to overcome the brown beams. I was also the lackey. My father, being a skilled builder, simply does not DO some tasks… like cleaning up. So I followed around behind him and the friends he had called in favours from as they ripped out and replaced my bathroom, tiled the common areas and installed new carpet in the bedrooms. For a significant period of time, there was no toilet in the apartment so I made frequent visits to the Hungry Jacks down the hill to avail myself of their facilities. It was filthy, repetitive work but ultimately rewarding – I was left with a fabulous new home.

As soon as I was ready to move in, I took a boarder for the second room at $90 a week including water and electricity. My first housemate, Michael, stayed for a year and subsisted almost entirely on baked beans and tinned spaghetti. His lovely girlfriend (now wife) was clearly a very tolerant woman. After that, I had Sam stay with me for six or so months. He was a young Muslim guy and a lot of fun to have around. Then he fell in love and moved in with his girlfriend, so I found Kerry, a Kiwi lass training as an opera singer. She stayed until Christmas of my second year in the apartment.

By then, I had graduated from chemical engineering at UQ and had a job offer in Kalgoorlie. I left Queensland but kept the apartment, renting it to a lovely couple I’d met at uni. After two years, they bought their own place and I turned the unit over to an agent. It now rents for $315 a week and would sell for between $300k and $350k. Because it’s fairly indestructible, it’s been low cost regarding maintenance – just the occasional water heater replacement, air conditioner re-gassing etc. And I put in a new kitchen before the agent took over. Actually, I did nothing – I just paid the bill and saw the kitchen in person two years later. It was great.

Having that apartment allowed me to secure a $170k loan for my home in Kalgoorlie in 2004 with no deposit. The equity is of benefit to every loan application I have made since. I thank my lucky stars that I bought it.

What did I learn?

Looking back, I can hardly believe the audacity of a 19-year-old student buying a property. I recall the shocked looks on the faces of my lecturers and parents of my friends when I told them, somewhat gloatingly I’m sure. It seemed to me that people didn’t know what to make of it, or perhaps they didn’t want to share what they were thinking because it wasn’t complimentary. My boyfriend at the time was less subtle: he thought I was crazy. That relationship didn’t last a month beyond settlement.

The lessons from this experience have been innumerable and highly profitable for me. Here are some of the lessons that stand out in my mind:

Negotiate!

Roughly paraphrasing from Robert Kiyosaki, you make your money when you buy a property, not when you sell it. You need to be willing to fight for the best price you can get and be willing to walk away if the stakes get too high. My father’s haggling saved me $1,500 I would otherwise have had to cut from my renovation budget – goodbye shiny new bathroom!

Ignore the nay-sayers

The tall poppy syndrome is rife in Australia. If people think you’re getting a bit big for your boots, they’ll cut you down in a hurry. This can be incredibly damaging to your confidence when you’re young and about to attempt something you’ve never done before. Have faith in the numbers and ignore those ignoramuses – they’re probably just heckling you because they’re jealous or too cowardly to do what you’re doing.

Get in early

Imagine if I’d hesitated for even three months? Perhaps I would have had to pay $200k instead of a little over $100k. I doubt I could have convinced the banks then. Property goes in cycles, but if you’re holding for the long term those even out over time.

Cosmetic changes can make a huge impact

Just painting and putting up new curtains made the apartment seem livable (and stopped my tears). Some people can’t see past poor presentation that is only surface deep. Have the guts to buy something that looks a little run down (making sure there are no structural issues of course) because chances are you’ll have less competition.

Take boarders to help with the mortgage

Know what the difference between the mortgage and the rent from my boarders was? $40 a week. You couldn’t rent a room in a hovel for that much. It was cheaper to own than to rent because I was willing to forgo some privacy. It wasn’t forever – in fact I haven’t shared a house with anyone but my partner in nine years. But it’s an excellent stop-gap when you’re just getting into the property market.

Then vs. Now

I love talking about property, so I end up chatting about it with lots of people. Whenever I tell this story, the reactions are varied. From my peers in their 30’s who still don’t own a property but wish they did, I hear: ‘Gee, I wish I’d bought when you did.’ From young people, I hear: ‘But it was different then. Property is so much more expensive now.’ And I ponder this.

I bought this property 13 years ago. There’s no doubt the world has changed when it comes to getting loans, and most of the changes make it harder to buy that first property. However, much remains the same. So what’s changed from then to now?

Worse: The Global Financial Crisis

Thank you, sub prime mortgages in the USA for making loans harder to get for a while in Australia. However, I’m not convinced it’s that much harder. I submitted the same volume of paperwork and was subject to far less scrutiny for a loan in August 2014 as the one in November 2001. And mortgage insurance is viable if you can’t find a 20% deposit – so quit whining and take the insurance.

Worse: Housing Affordability

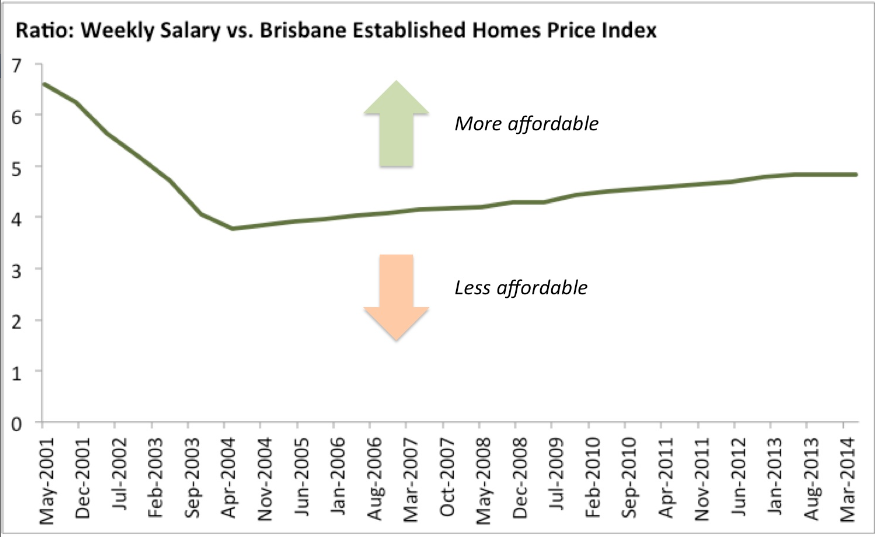

There is no doubt that that house prices in Australia have risen over the last decade. They rose the decade before that too, and the decade before that. In fact, on average they seem to rise most years. It’s called inflation. The question is whether the rise is reasonable or not. I used the average weekly salary of a full-time employee (Australia wide) and the housing price index for established dwellings (Brisbane only) from the Australian Bureau of Statistics to see if there was any truth to the complaint that owning a home is less affordable now…

Turns out that’s true. I was very, very lucky to get in early when affordability was high (left of chart). However, you will note that after a sharp decline towards 2004, affordability has been steadily increasing ever since. So it’s getting better, not worse (in Brisbane at least). And I’m always brought back to the concept that if I could do it as a second year uni student, my employed 30-something friends should be able to do it too.

Worse: Expectations

It blows my mind that people expect to buy their dream home, with all the renovations complete, as their first home. They think they shouldn’t have to take a boarder because they don’t want to share. They’re not willing to compromise on their lifestyle in the short term. Where do these unrealistic expectations come from? Are they a product of marketing and those Ikea catalogues that appear in my mailbox once a year? Are we just so hell-bent on instant gratification that we don’t realise these homes become perfect after someone puts in the time and $’s to tart them up? The property ladder is real, people. You start at the bottom, or at best somewhere in the middle. You don’t jump right to the top without a windfall of cash.

Same: Interest rates

I recently found my Consumer Contract Schedule and saw my introductory interest rate was 4.89%. Three years ago, that would have had me reflecting on the good ol’ days and wondering if I’d ever see the like again. My current interest rate? 4.9%. And that’s not an introductory rate. Rates have been the same for most of 2014 and there’s no sign of an increase any time soon. It’s a cheap time to be borrowing cash.

Same: Urgent sales

Every circumstance is different, but like then there are people desperately trying to sell their properties and they are willing to take a lower price to do it. Divorces, deaths, redundancies – these items force the hand of owners sometimes. There are always people who don’t have much choice or time, your task is to find them.

Same: Ugly places sell cheaper

When I was looking for apartments in 2001, there was a black and white ad in the paper, text only, with the basic stats. You had to go to the home to see if it was any good. The rise of the interweb makes that process a lot more sophisticated. Marketing is critical: the pictures of the home for sale have to look like they come from the pages of a magazine to get a reasonable number of clicks, which then translates to more people attending home opens. From the comfort of my home, I can check the lay of the land from Google Maps. I can download a full property report including the sales history for less than $50. The average buyer can do a lot of research to narrow down the places they’re willing to look at. This can be to your advantage if you’re willing to check out the places that don’t look so great – the ones with old kitchens, scruffy yards and a poky little laundry. Be willing to check out the ugly places and you might just find a bargain.

Where to from here?

If you’re thinking about buying a property, here’s some points to consider:

- Get real about what you can afford. Don’t expect to buy your dream ‘forever’ home first off. Aim to buy something you can keep as a rental later when you’re ready to move up the property ladder. Do your balance sheet so you can present a convincing case to the bank when the time is right. Don’t go to home opens in the bracket above your affordability, you’ll just be depressed.

- Stop putting it off. If you’re planning to hold your property for the next 10 years, odds are strong that you’ll make money over that time. The longer you wait, the more costly it is to get in, and the less value your savings (thanks to inflation). Get serious and get moving!

- Practice negotiating. The price you pay for your property is really important. Be prepared to be uncomfortable as you negotiate the best price you possibly can. Get a shortlist of possible properties and make unbelievably audacious offers – 15 to 20% below the asking price. Be prepared to be hung up on, yelled at and kicked out the agent’s office. I’ve had all three, and after the first time it’s not so scary.

- Read ‘Rich Dad, Poor Dad’. Robert Kiyosaki’s book is a regular read in my house. Ignore his advice on buying property at your own peril.

Got a teenager that needs an incentive to save? Share this story with them. If I could do it, they can do it too!

Have you got a property investing story you’d like to share? Or perhaps some other kind of investing you tried early in life? We’d love to hear about it – please leave a comment below.

What comes next?

Download our Free Financial Resources

Find the right Money School Course for you

Get the Book: Money School, Become Financially Independent and Reclaim Your Life, Lacey Filipich

Got a question: Contact Us

Lacey Filipich is the co-founder and director of Money School. She helps parents raise financially savvy kids and helps adults get on top of their finances. Connect with her on LinkedIn and follow Money School Facebook to learn more.

Lacey Filipich is the co-founder and director of Money School and Maker Kids. She helps parents raise financially savvy kids. Connect with her at Maker Kids on Facebook to learn more, and be sure to grab your free eBook via the form below: