We’re thrilled to share the TEDxUWA talk Lacey delivered on 13 October 2018 to over 400 people at UWA’s Octagon Theatre:

Prefer to read? Here’s the transcript:

A decade ago, I was the definition of time-poor.

I was on the fast track to a VP role in a major mining company and I thought my work was so important that I could not afford to take even a single day off. So I didn’t, for 18 months. I was working my butt off. Sadly only in the metaphorical sense. In the literal sense my butt was expanding thanks to my neglect of everything not related to work.

That all came to a halt when I fell ill and not just a little bit ill. I was bedridden for five weeks.

If you’ve ever had an experience of being ill for longer than you thought of, you know, like a common cold you think’s going to be one week, drags into two, drags into three. Some of the feelings I experienced were things like helplessness, like I had no control over my body, like I could do nothing to get myself out of bed, like all that motivation and ‘get up and go’ that had got me so far in my career was going to be no use to me.

I also felt hopeless, like that bed was going to be my future. I was just going to be surrounded by tissues from crying my eyes out for the rest of my life and it got so bad that in week four I stuffed myself full of every drug they’d given me and got myself on a plane and flew 4,000 kilometres home to my mummy so she could look after me.

It turns out that it was a virus that sent me to bed but it was my poor health choices and my lack of energy reserves that kept me there.

As a result of that sickness I’ve lost half of the hearing in my right ear and I now have gold crowns which I call my ‘mouth bling’ on my rear molars because I split my teeth in two grinding them in my sleep from the stress. Having your health irreversibly damaged when you’re 26 years old is no fun at all. But it was the wake-up call that I needed.

I decided to take leave without pay and went travelling to South America with my partner. And having now seen it I can say there’s nothing quite like a man-made marvel such as Machu Picchu to put the insignificance of your work into perspective.

Adam and I getting some perspective around Christmas 2008

Three months later I had seen six countries and my eyes had been opened to a world beyond work and beyond Australia. And I thought about why I had made work such a big part of my life when there seemed so much more to be discovered.

Alas, all good things must come to an end. I flew home and back to work. When I got back to work, it was a bit of a shock but I soon fell into my old routine.

Until three months later, my little sister Megan committed suicide. She was 24 years old and I thought she had everything to live for.

Megan’s death brought that idle pondering into sharp focus. I became consumed with questions about why we work ourselves to death, why we spend so much of our time at work not enjoying it, and sacrificing so much. My life to that point was an example like a textbook. I had allowed myself to be worked to the point of physical and mental collapse for a company that would have replaced me within a week if I’d gone under a bus.

It seemed like a waste of my time and like most people in personal crisis I went looking for help and I started in the self-help section of a book store back when you used to, like, actually go into a bookstore. And that’s when I came across Tim Ferriss’s 4-hour Work Week and it was a revelation particularly on the topic of time.

It’s no surprise that time-poor is the catch-cry of our era because it’s our most precious non-renewable resource.

We lament the lack of hours in the day to do all that we could want to do never mind that you and I have the same 24 hours a day as Beyonce or Barack Obama. It just never feels like we have enough time and that’s over the microscale of a single day.

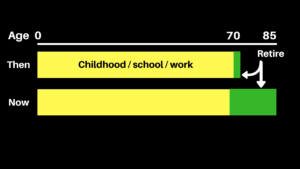

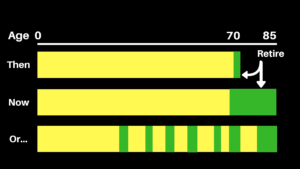

Over the macroscale of our lifetimes, we spend 40 plus of our best years grinding away – sometimes our teeth – at work and then finally we reach the official retirement age and we get to stop. We finally are time-rich instead of time-poor. We can do whatever we want with our time. We could travel, we could volunteer, we could spend time with our families. Only now we’re old. What we wouldn’t give at that point to have some of that time-rich feeling when we were young.

The thing is, we made end-of-life retirement up. It’s not compulsory. Retirement was invented in the 1880s in Prussia in response to socialists demanding more for the public. And at the time they set the retirement age at 70 years old and that was the approximate lifespan in that era. So not everybody got to retire. They didn’t actually get to have what we get now. And when they did retire they probably only got a few years.

Retirement became widespread in the work scarce times following the Great Depression when it was seen as a way to get older members of the workforce out of the way so that younger people could come through because they needed that money to raise their families. Times have changed, lifespans have increased, and yet end-of-life retirement remains. And the retirement age is pretty comparable, around the mid-60s for most developed nations. So now instead of having a handful of years for a handful of people to look forward to, most of us are looking at two decades of that time-rich feeling when we’re old.

From 1880’s to 2010’s

In the book, Ferriss asked the question what if we could take some of that end-of-life retirement and bring it forward into our youth in small chunks so we could have that time-rich feeling when we’re young and healthy? He called these small periods of respite mini-retirements.

My trip to South America had a new name. It wasn’t a holiday, it was a mini-retirement and I was thrilled by the idea of making them a regular part of my life so I set about redesigning my lifestyle and my work. I promptly quit my job and in five years I took five mini-retirements totaling 22 months off. In between those periods of mini-retirement I would do consulting gigs in the mining industry and I’d also tinker with my startup which later became my business.

Now, the question that might be rising in your minds right now and it’s a logical one is how does someone in their late twenties afford to take more than a third of their time off work? How do they afford a roof to sleep under or a car to drive? How do they afford to eat?

It’s a really important question.

In the book, Ferriss talks about a muse, an online business that can be used to fund your mini-retirement so that you can be off sipping cocktails on the beach while money is pouring in from the sky from the web. But that’s just one way to make mini-retirements a part of your life. There’s another alternative and it’s called FIRE. And what does FIRE stand for? Financially Independent Retiring Early.

It’s a term coined in the mid-’90s by Vicki Robin and Joe Dominguez. And it’s a very simple, which is not to say easy, concept. Basically you stop spending so much on stuff. You take the money you would’ve spent on stuff and you save it. And once you’ve saved it, you then buy assets with it. Assets are things that pay you, things like property, shares, bonds, index funds. And you keep going like that through your working life and eventually you reach a point at which the income from your assets is enough to sustain your lifestyle. At that point you don’t have to work anymore because you don’t need a wage to survive. Working becomes a choice.

Let’s use an example. I’ll talk about Fred. Fred’s a software engineer. He graduates from university and gets his first job and he does not make the mistake that most of us make which is going out and spending every cent he then earned because he was so excited to finally have an income. Instead he keeps living like a student, you know, baked beans on toast, that kind of thing. And he keeps going like that and he manages to save 60% of his income. Think about that for a minute, living on 40% of your wage.

He keeps that up for 10 years. He takes the money and puts it into an investment property and into some index funds. And then at 30 years old suddenly the income from his assets is enough to meet his living costs which are about half of those of his peers because he hasn’t gotten into the habit of spending so much money. At 30, he can choose to stop working, he can retire.

Fred’s a real person. His name’s actually Pete Adeney and he goes by the moniker Mr. Money Mustache. And he’s one of a slew of bloggers out there who’ve been through this experience. They’ve had the chance to reach FIRE and now they teach other people how to do it.

Lucky for me, I came to FIRE, and my beginning of that journey, much earlier. I started when I was 10 years old. My mum taught me the importance of saving and taught me about the power of compounding. And as a result I saved half of every dollar that I ever got from that age whether it was from pocket money or birthday money or the profit from my first business which I started at that point.

When I was 14, I was old enough to get a job, I got two. And I kept saving. And then at 19 years old I was in the second year of my degree in chemical engineering and I had a pretty impressive bank balance and I was going to buy a car with that bank balance and it wasn’t going to be a crappy old bomb like my friends were driving. It was going to be gorgeous. It was at least going to have air conditioning and power steering and I was very excited about the fact. So I showed my mum. I said Mum, look what I’ve saved. I’m going out to buy this car.

And my mum said one sentence that changed my life. She said, “Lacey, that could be the deposit on a home.”

My mind was blown. It planted a seed which took root and within a couple of weeks we were out apartment shopping. And a few months later I was the proud owner of the ugliest, brownest, crappiest tiny apartment you have ever seen. But at 19 years old that was pretty exciting.

A couple of years later I graduated from university and I flew 4,000 kilometres away to the wild west of Australia to join the mining industry. And because I did a bit like Pete Adeney, I didn’t extend my living to the income that I had, I was able to save quite a bit of money. And so I bought another property when I arrived. Couple years later I bought another property.

Then my employer introduced a share scheme and so I started learning about shares and I got interested in that. So I started trading in shares as well. And I kept going with property and shares and so by the time I was 26 and I had that experience of the health breakdown, I was actually well on my way to financial independence.

And that’s a point that I reached when I was 31 years old which was fabulous timing because that’s when I had my first child and I had the luxury of being able to stay at home with her and not have to think about how I was going to earn an income because my assets were paying my living costs.

After about 18 months at home I finally got some sleep, as you do, and I started thinking about the meaning of life and what I wanted to do, which is also what you do when you’re at home with the toddler it turns out. And I was growing increasingly frustrated with my friends who had been making terrible financial decisions, getting into bad debt, paying way too much for things that they really wanted like cars, and not saving and not investing.

And I looked back on our school system and realised that we are not getting taught about money. We’re not even taught that FIRE is an option at school. I’d never even heard the term. And so my life became about teaching young people the skills they need to become financially independent so they can have what I’ve had.

At that point, I moved full-time into my startup, Money School. And a couple of years later I started a second business, Maker Kids Club, which tackles the same problem from a slightly different angle. And those two businesses plus being a wife and a mother and a handful of volunteer roles are where I spend most of my time.

Now, that doesn’t sound too much like retirement, does it? And here’s where FIRE falls down. Sipping cocktails on a beach gets boring eventually. You’ll have to take my word for it. Young people when they reach FIRE don’t actually retire. Just read their blogs. These are not the kinds of people who sit around twiddling their thumbs or doing nothing or watching endless reruns on TV. They’re out changing the world.

The difference is that their work is not motivated by money. It’s motivated by other rewards. They aren’t retiring early. They are in fact time rich.

This point is so important I’ve dedicated an image to it.

They get to choose how they spend their time. And that’s the point of this exercise. It’s to be able to choose how you spend the seconds, minutes, hours, and days that will make up your life. You choose if you work, when, where, how, on what, and perhaps most importantly, with whom you work. You get to choose when you stop working and you get to choose when you start again. You get to choose because you don’t need a wage to support your lifestyle.

So if you’re thinking this FIRE idea sounds fabulous, don’t make early retirement your goal. Make your goal time rich.

And if you’re still not convinced, here’s why we all need you to be time rich.

Humanity has pressing problems, overpopulation, pollution, homelessness, war, food production, the list is endless. If we can’t solve those problems, all of our time will be meaningless. We need our brightest minds focused on solving these problems not working out how to get us to click an ad. So I implore you, save and invest. Catch FIRE Become time rich. Discover the joy of work that is not motivated by money and start solving those problems that fascinate you.

We, humanity, need you to. Thank you.

What comes next?

Download our Free Financial Resources

Find the right Money School Course for you

Get the Book: Money School, Become Financially Independent and Reclaim Your Life, Lacey Filipich

Got a question: Contact Us

Lacey Filipich is the co-founder and director of Money School. She helps parents raise financially savvy kids and helps adults get on top of their finances. Connect with her on LinkedIn and follow the Money School Facebook page to learn more.

You’re a legend! Finally someone that speaks my language

Thanks Shaun 🙂 Thrilled to hear it.

Hi Lacey

I am new to FIRE and have been obsessed about reading and listening to everything on it!. 🙂 This is a great article!!

I just read this article with my 9 year old son and he was listening intently. I am trying to teach him about, saving, investing and compounding. Hopefully he will instil great habits like you did at such a tender age 🙂

Michelle and Devon

P.S- we are also in perth :p

This is great and expresses what I was trying to do to a certain degree already – intuitively. Being 49 and having 2 kids in the age of 8 and 10, I have been thinking a lot on how to keep them grounded and at the same time to empower them to live a live they want – and can finance. I love the idea of Money School and I could consider doing something similar here in Germany. Thank you for the inspiration Lacey!

Amazing talk Lacey. Many people may never learn this without people like you. You are on a great crusade.

Thankyou for sharing your life learnings… so far.