I was in studio with Geoff Hutchison for ABC Radio Drive last Friday 3 June talking about what you need to be looking at in the next few weeks regarding your superannuation.

I thought a checklist might help those of you wanting to get onto the options I covered.

(If you prefer to listen, you can catch the replay here in the next week or so – my segment runs 1:18 to 1:29)

Here’s your to-do list to complete before the end of the financial year (30 June 2022):

If you’re earning less than $51,837 a year…

…you could get some FREE MONEY from the government!

That’s right. Free money. Not to be sneezed at.

The government offers a co-contribution scheme into superannuation. If you make a voluntary after-tax contribution of $200-1,000 (depending on your income threshold), the government will match up to 50% of that contribution, i.e. $100-500.

Find all the details including eligibility criteria on the ATO website.

If you’re earning more than $18,200 a year…

…you could contribute more than your FY22 cap of $27,500 to give your super a boost.

Each year, we’re allowed to contribute a certain amount to our superannuation at the concessional rate of 15%. This includes compulsory (employer) and voluntary contributions.

Given that you’ll be paying at least 19% tax on every dollar over $18,200 in a year, maximising your contributions to the cap can be a way to get more money in your pocket (eventually – remember you can’t access superannuation till you reach a certain age and eligibility).

Even better, you can use up any caps that went unused in previous years. That’s on a five-year rolling basis, but it only started in FY19, so at the moment you can only access your unused cap from FY19, 20 and 21 in addition to the current year, FY22.

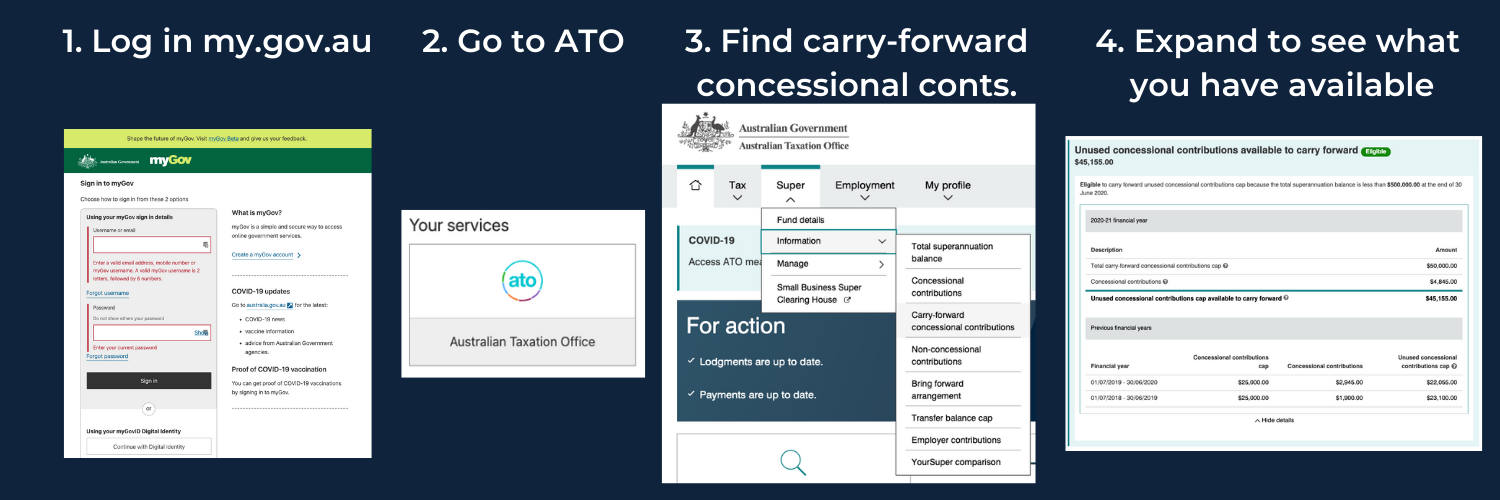

How do you know how much unused contribution cap you have availabile?

- Log in at my.gov.au

- Click through to the ATO (or connect to the ATO first if you aren’t connected already)

- Go to Super > Information > Carry-forward concessional contributions

- Select the most recent financial year and expand to see what’s available in past years.

POST EDIT: Please note that one of our readers (thanks R!) had pointed out that if you’re not using single touch payroll (e.g. if you are a sole trader), the ATO’s system may not show accurate data. If you believe there’s an error in your data, you can check your records to see how much super you contributed in past years and take that away from the $25,000 a year cap (FY19, FY20) or $27,500 a year cap (FY21).

You might not be able to see it in the small screenshot on the right, so here’s the detail:

In FY19 and 20 I have $45,155 still available to contribute.

(Remember I don’t max my super. I prioritise investing outside super. That’s why it’s so high).

Now what?

Next, you decide if you want to take up any of that unused cap.

In this example:

In FY22, I could make a voluntary concessional contribution of up to $45,155 from my salary. This would be taxed at 15%, on top of whatever I contribute in FY22 – as long as I’m under the lifetime cap and current year limits.

If I was earning over $180,000, paying 45% tax, I’d consider using up some of that cap.

Even if you’re not on high wages, this is especially attractive for those returning to work after long breaks from earning super. People (especially women) with young kids: I’m lookin’ at you!

If you do make a contribution, be sure to submit the paperwork to your superannuation fund so it gets counted properly. That’s the ‘Notice of intent to claim or vary a deduction for personal super contributions’ form. Otherwise, you may pay more tax than you need to.

Of course, putting money into superannuation isn’t a no-brainer.

You might have other priorities. Maybe you have a mortgage. Maybe you’re not sure if extra contributions are right for you, right now. This is a good time to get advice if you’re not sure.

Just remember that if you ask your super fund what you should do, they’ve got a vested interest in you putting more into your super 😉

If you have a spouse not earning much superannuation…

…you may like to make a non-concessional contribution to them.

You don’t get the concessional rate at the time of contribution. But if you meet the eligibility criteria, you may get an 18% tax offset up to $3,000 of contributions when you lodge your tax return.

If you have a child not earning much superannuation…

…you may like to make a non-concessional contribution to them.

Again, you don’t get the concessional rate. But if doing some after-tax gifting or investing on their behalf was on your to-do list, this can be a way of achieving the same outcome. As long as you don’t mind locking up the money until they reach retirement age, of course.

If you’re saving for your first home…

…you might want to see if you qualify for the First Home Super Saver scheme.

Because you can only contribute $15,000 per financial year, you might like to take advantage of what you could contribute in FY22 right now.

And while you’re looking at your superannuation, what a perfect time to…

See if your superannuation stacks up on fees and returns.

The YourSuper comparison tool is brilliant for a pulse-check on whether you’re getting a good deal.

You can also use our handy guide to help you decipher your statement.

If you’re not happy with the performance of your fund, now’s the time to consider a move. Future You may thank you for the extra tens or hundreds of thousands of dollars in your super fund when you’re ready to retire.

Got other tips to share?

Please add a comment if you’ve got another great super idea to share with the Money School community 🙂