I would not be the first person you’d ask about how to get physically fit – but financial fitness? That I can help you with 🙂

Getting financially fit is similar to getting physically fit in many ways:

- There’s no one-size-fits-all recipe,

- …but there are some (almost) universal guidelines that are wise to follow,

- Habits matter, and

- Progress will depend on your starting point and your circumstances.

In one big way, getting financially fit has the edge on its physical equivalent. Unlike dubious products promising you’ll drop four clothing sizes in a month, there are financial fitness shortcuts which are proven and low risk.

Even better, you can automate some of them.

Before we get to those shortcuts and automations in future blogs, it’s time to take stock.

After all, you don’t just walk into the gym after 10 years as a couch potato and expect to benchpress your bodyweight, right? The first step in getting financially fitter is knowing where you are, right now.

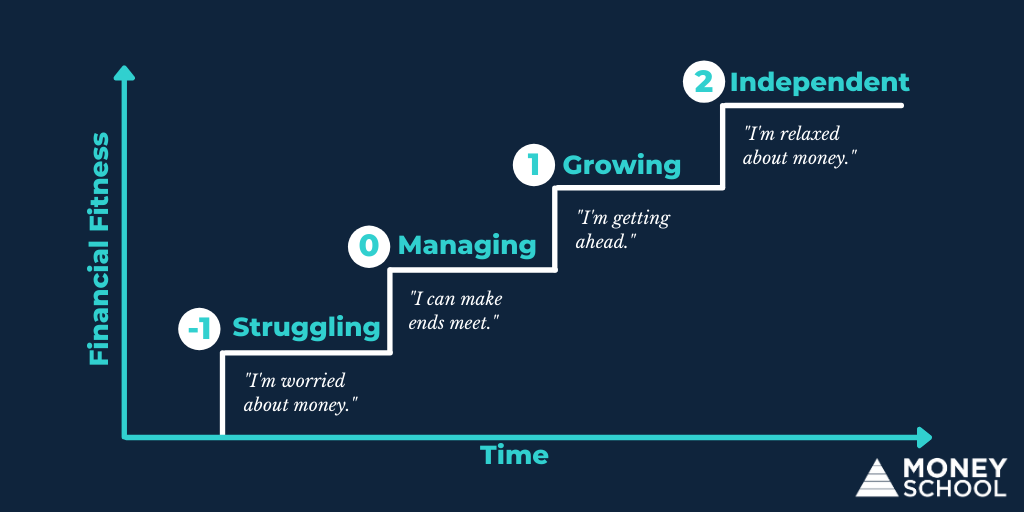

The Four Stages of Financial Fitness

Read through the description of each stage. Which one most fits your current life?

-1. Struggling

Yep, we’ve got a negative on this scale. With money, it’s possible to be so far behind that you’re in negative territory. It’s the equivalent of having ignored what you eat, how well you sleep, and exercise in general for at least a few years.

Struggling with money looks like:

- Not being able to afford basics.

- Relying on debt to plug the gap between what you earn and what you need to spend.

- Having no cash savings to fall back on in emergencies.

- Not having a plan for your money, or your budget is so tight there’s no room to move.

- Financial abuse – such as having your access to money limited, or your right to work curtailed.

Struggling with money feels like:

- Being worried, anxious or depressed when you think about your finances.

- Wondering if you’ll ever get ahead.

- Feeling your financial situation is so hopeless that you may as well not bother.

- Terrifying, if you’re in a situation of coercive control and don’t know how you’ll get out. (Note: please check out Financial Toolkit as a first point of help).

0. Managing

Consider this the beginner level of financial fitness. It’s the equivalent of knowing your way around the gym equipment and managing light reps, but getting out of breath easily if you’re pushed.

Managing looks like:

- Making ends meet.

- Having a small cash buffer that you could use in an emergency.

- Not needing debt (such as credit cards or BNPL) to cover basic living expenses.

- Knowing where most of your money is going.

Managing feels like:

- You’re not often stressed about money.

- You can afford what you need – but maybe not everything you want.

- Your’e staying still – not getting ahead, but not falling behind either.

- You’re stressed about your retirement, and worried about how you’ll survive when you can no longer work.

1. Growing

Equivalent to an intermediate level, this is where you’re pushing yourself to go further. More reps, more sets, more stretch targets.

Growing looks like:

- Paying Future You in the form of savings.

- A nice, comfy cash buffer fund to fall back on.

- Using those savings above the buffer to invest in assets that go up in value and can pay you.

- Using debt wisely – for example, to buy an asset.

- Working towards increasing your income, reducing your spending, and/or ramping up your investing.

Growing feels like:

- Your money is working on your behalf.

- You’re motivated to achieve clear goals you’ve set.

- You’re looking forward to a retirement (early or at pension age) during which you can afford what you want.

- Your money empowers you, and you’re not worried about it.

2. Independent

At this point, you’re into mastery. Bench pressing your body weight is within reach and you’ll get there any day now.

Independence looks like:

- Your assets are paying you an income.

- You’re debt free, or using debt as a tool to further your financial position.

- You’ve structured your affairs to optimise your tax obligations and protect yourself.

- Earning a wage is optional.

Independence feels like:

- Being relaxed about money – it’s a source of joy rather than stress.

- OR: It’s not even thinking about money in the day-to-day sense.

- You’re excited about the future and getting to choose how you’ll spend your time.

…so, where are you?

What’s next?

Now that you know where you are, you can think about how you’ll move up to the next financial fitness stage.

I’ll write a separate blog for each step up:

- Struggling to managing

- Managing to growing

- Growing to independent.

…and I don’t have to write them in order, so let me know in the comments which one you’d like me to write first 🙂

Hi Lacey, thanks for this thought provoking post. After many years of struggling as a single mum on DSP I began Managing when I moved into public housing. Now I am starting to Grow. But I honestly don’t see that I will ever reach Independence. I am interested in hearing more about the transition from managing to growing if you are on a fixed low income. Thank you.

I really enjoyed today’s email about giving ourselves credit, too. Thanks!

managing to growing

This is such a great model, really simple but such a useful way to get a reference point on the journey. Thanks.