I understand what all the fuss is about.

I learned a lot from this session, and below are my main takeaways. If I’ve gotten any of this wrong, it’s my fault, not the Professor’s. Apologies for Professor Yermack in advance if I’ve butchered his eloquent explanations.

- Cryptocurrency is coming, regardless of whether we want it or not. Possibly, sooner than you think. It seems unlikely there will be an ‘opt out’ available. You’ll have an online cryptocurrency account or you won’t have money.

- Employment prospects for future lawyers, accountants, and those considering banking look grim.

So, what did I hear that lead me to these conclusions?

Bitcoin and Blockchain Banking are not the same

Blockchain is an encryption technology. Bitcoin is a currency that uses that technology. It was the first currency to do so, which is why the two terms seem interchangeable. But they’re not.

A blockchain has been described as:

- a trust machine,

- magic,

- a black box,

- disruptive, and

- the death of auditing.

I now think of blockchain banking as technology’s answer to the question:

“How do I know that my transaction is secure and honoured, beyond all doubt?”

How Blockchain Banking is different from traditional banking.

At the moment, banks process transactions in a clearing process, which takes place at set times and on set days. Banks are the official custodians of how our money moves. They take the role of ensuring the right money goes to the right entity. Banks interact with lawyers, auditors, accountants, stock exchanges and government departments stamping things. They ensure that the assets associated with these money movements move as intended.

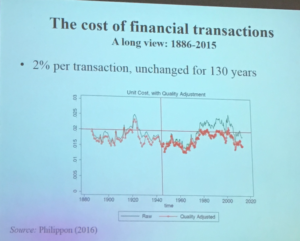

We rely on banks to be our record keepers. We pay them for the privilege to the tune of 2% since the late 1800’s. We pay any number of different rates to the other professionals that help.

Photo taken from Professor Yermack’s presentation, referencing Philippon, 2016. We’ve been paying 2% for finance since 1886 apparently

Blockchains do away with the need for most of that, and most of the cost associated too.

This is why we might be looking at a generation of bankers, auditors, accountants, and lawyers looking for new jobs.

What’s a blockchain?

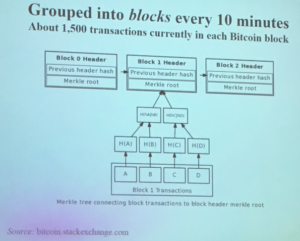

Baffled by various oral attempts to explain this to me before, I now realise a drawing would have helped. It was an absolute thrill to see this image in Professor Yermack’s presentation. It shows how the ‘block’ and ‘chain’ relate:

Photo take from Professor Yermack’s presentation, referencing bitcoin.stackexchange.com. Hash headers and merkle roots – don’t worry if these mean nothing to you

The ‘block’ part of blockchain

The ‘block’ is a group of transactions – much like the clearing batches banks use, but smaller. There are up to 2,000 transactions in a Bitcoin block, for example. Each individual transaction is connected to the next one up a tree called a ‘merkle root’, which forms from the bottom up.

In the above image, there are four transactions – A, B, C and D – at the base of the tree. Each transaction gets encrypted in a hash header. This is a mathematical way of assigning an identity to that transaction that makes it unique. Header A and Header B combine to make a new header, Header AB. Header AB is unique from all other headers. It can only result through the combination of Header A and B in that order at that time. Transactions C and D do the same, creating Header CD. Header AB and Header CD combine to make Header ABCD. Again, this header is completely unique and determined by the encrypted transaction IDs. There are 1,500 transactions in the average Bitcoin block. You can imagine the complexity of that merkle root. And that’s one block.

Which brings us to chains.

The ‘chain’ part of blockchain

The ‘chain’ is the connection of the blocks. Block 0 codes into Block 1, then Block 1 codes into Block 2, bringing the code from Block 0 with it. In this way, every block identifies all previous blocks. The full history of the transactions that pass before are included in the current block.

The result: full and complete transparency. You can’t lie about what money went where. This is why it’s called a trust machine. It’s a completely decentralized system, where each user holds every other user to account. No bank needed to confirm which dollar goes where – we do it ourselves. No auditors needed to check we did what we said we did – it’s visible to anyone who cares to look.

Little wonder people think it’s magic.

Logistical challenges and how cryptocurrencies overcame them

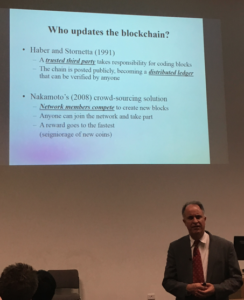

So, we now have an encryption tool that does away with the need for banks, auditing and most lawyers. But who administers it, and how do we pay them?

Enter Bitcoin.

…followed eventually by Etherium and dozens of other cryptocurrencies. You see them popping up now as Initial Coin Offerings (ICOs).

Bitcoin began in 2009 thanks to Satoshi Nakamoto, whose identity remains a mystery. In 2010 you could buy a single Bitcoin for five cents. Today, that same Bitcoin is worth A$7,403. That’s 148,000 times the original investment, an outstanding return by any measure.

It pays to keep track of your Bitcoin files, as one Welsh IT worker learned. He threw out a hard-drive with 7,500 Bitcoin in a fit of spring-cleaning, only to realise four months later what he’d done. It would have been worth 4 million pounds at that time. He gave up on the idea of searching for it when he saw how much rubbish was piled on top. It would now be worth over A$55 million.

The downside of making access difficult to fake

No, the Welsh IT dude couldn’t get to that Bitcoin any other way. You must have your account file to access your cryptocurrency online. There’s no bank you can walk into with your license and confirm that money is yours. There’s no central administering body that will verify your identify and give you a new copy of the file. You can’t pull it out of the bank and keep it under your mattress. You lose that access file? It’s gone. This is part of the reason it’s so secure.

I learned this recently when my mother and stepfather went to Europe. They couldn’t just write down their banking details for me to help move cash in the event of an emergency. They had to give me a USB with the files on it and show me how to use the file to open their cryptocurrency ‘wallets’ online.

And yes, it’s all online, requiring immense computing resources. Which gives rise to the next question:

Who provides the computing power for all this blockchain banking?

Short answer: we do. This is a completely decentralized system, with no government or corporation managing it. If you and I had to provide the computing power necessary to encrypt our own transactions, we’d never have enough bandwidth to check Facebook.

So, cryptocurrencies need to entice people to commit these computing resources. They’ve solved this problem neatly:

Cryptocurrency transactions still incur fees. They are measly compared to the 2% bankers have charged for the last 130 years, but they’re still there. With no central governing body, they give these fees back to the users as a reward for whoever starts a new ‘block’. To use Bitcoin as an example: these blocks start every 10 minutes, and starting a block earns you around $60,000. Of course, this introduces a new industry, called cryptocurrency mining. Instead of digging minerals out of the group, you’re competing to start the next block. With $60,000 up for grabs every 10 minutes, it’s very lucrative. This justifies rooms full of computing hardware that you dedicate to a cryptocurrency.

There’s a new Ethereum block starting every 12 seconds.

(Maybe cryptocurrency mining will the on the list of upskill options for our accounting and lawyering friends!)

What does this mean for you?

Professor Yermack’s hypotheses include floods of unemployed bankers and auditors. He pointed out that blockchain is a no-brainer for anyone who manages financial transactions. Banks and stock exchanges are the first entities that spring to mind. Introducing blockchain technology shortens settlement periods from days to seconds. It will also guarantee the security and transparency of their records.

It is only a matter of time till this happens. Continuing to charge 2% as cost of finance when your competitors charge next-to-nothing? A recipe for failure.

The flow-on effects of wide adoption of blockchain banking would be massive:

- Cost of finance would drop from 2% to negligible. This is in part thanks to needing fewer employees.

- You may find we don’t need several competing banks vying to sell us debt. Instead, you could have a single central bank per nation. In Australia this would likely be the Reserve Bank.

- There would be no hard currency. Say goodbye to coins, notes and stashing anything under the bed, which leads to…

- …banks offering negative interest rates. No one will have that hard currency stashed away out of the view of the bank, so it could legitimately work.

This end state is probably a good thing for us all. The world carries on without bankers.

Photo taken from Professor Yermack’s presentation. Thank you Professor Yermack – what a relief to finally understand!

While we’re waiting for tomorrow to arrive, we’re in an interesting period:

- Cryptocurrencies are digital only. You can only use them through your digital wallet or a Visa card connected to that wallet.

- Those cryptocurrencies are not overseen by any kind of authority. Not a government, not a corporation, nothing…

- …which is why they’re touted as havens for criminals: the tax agencies have no visibility on them.

- Their markets are ‘frothy’: astronomical price rises and drops are common.

So, should I be buying Bitcoin now?

…or Ethereum, or any of the other cryptocurrencies on offer?

One day, Australia may wave goodbye to CBA, NAB, Westpac, and ANZ. You may find yourself with an RBA account held in an Australian cryptocurrency. When that happens, it’s unlikely that they’ll take away any of your wealth without causing a revolt. So, just because crypto is coming in doesn’t mean you stand to become destitute.

The question is: do you want to speculate now in the hope of a quick profit?

Cryptocurrencies are still currency. Since the abandonment of the gold standard, currency has no intrinsic value. It’s kind of meaningless. If you’re the kind of person who finds trading foreign exchange exciting, you might like cryptocurrency. If you have a large amount of money you’d like to remain invisible from tax agencies, you will want to have a look. If you enjoy gambling, you could switch from lotto/the nags/the dogs/the pokies to speculating.

But don’t invest money you are going to need immediately, especially not if it’s destined for something important, like your mortgage.

I’m toying with the idea. My recent enjoyment of short-term share trading may turn out to be some kind of gateway drug. It might be sending me down the slippery slope towards Bitcoin and crypto mining.

Or not.

Are you excited by bitcoin and blockchain? Tell us about it below.

What comes next?

Download our Free Financial Resources

Find the right Money School Course for you

Get the Book: Money School, Become Financially Independent and Reclaim Your Life, Lacey Filipich

Got a question: Contact Us

Lacey Filipich is the co-founder and director of Money School. She helps parents raise financially savvy kids and helps adults get on top of their finances. Connect with her on LinkedIn and follow the Money School Facebook page to learn more.

Toying with the idea too Lacey – look forward to discussing it with you further!