Ever thought about becoming a share trader? Ever heard of the stock market rollercoaster?

The stock market can be a nerve wracking pastime. In this Blog, Fran shares her recent experience with the highs and lows of share trading!

Monday :

As usual I logged on to our online share trading platform and checked how the numbers looked. It is early August, so I had a quick look to see if there were any opportunities to sell calls but found none I liked. Logged off feeling happy because the bottom line under the “Change in Value” column was a green one. This often is not the case as most of our shares pay good dividends and have some volatility so I can sell calls. Having our SMSF portfolio worth more than we paid for it feels great.

Tuesday :

I was busy so I didn’t log on.

Wednesday :

I logged on and almost fell off my chair! WTF happened? That green 10% profit figure has changed into a red 10%, so 20% of the value of the entire portfolio has vanished in a day. Is this another GFC in progress I wonder, or has Donald been tweeting more alarming stuff than usual? Is this what they mean by the ‘stock market rollercoaster?’.

It doesn’t take long to find the cause, one stock in our portfolio – RFF – has plummeted almost 50%. I’m feeling pretty sick by this point. I had been the one who did the research on this stock and recommended we put some money into it. RFF is a REIT, that’s a Trust that owns real estate. In this particular case the real estate is Australian agricultural land. With interest rates falling we were keen to find a home for some money that was in a term deposit, where it would still be safe and give a better return. A REIT isn’t guaranteed like a term deposit, so it is higher risk. But there are very real assets backing up the value, so we felt comfortable with the risk. There was also a good history of regular distribution payments close to 5% per annum.

Not smiling now, that’s for sure!

Having abandoned my plans for the morning I soon found out what had happened. An American organisation – Bonitas – which calls itself a “Short Seller Activist” has published a rather damning report on RFF calling into question various figures in the financial reports. There’s been a bit of crazy trading on the ASX and a trading halt has been called. In a way that’s a good thing, I can’t follow through with a “knee jerk” reaction and hit SELL.

Every course on Share Trading includes a discussion of the premise that these markets are driven by FEAR and GREED. Even in this advanced age, when you would hope research and statistics and verifiable analysis would play a much bigger role. Now I find I’m living in the FEAR zone and feel quite prepared to join all the sheep leaping over the cliff. I may have to resort to chocolate with morning tea to get the endorphins back in command 😊

Once the panic subsides, I slip into analytical mode.

I’m having a look at Bonitas first. What could a “short seller activist” actually do, I ponder. Short selling relies on a share price going down to be successful. An activist by definition takes action to achieve something. Hmmm, so their stated purpose is to take action so that share prices go down. Someone selling short will make a profit if the share price goes down – there’s the GREED angle coming into play.

To be fair, there are more altruistic aims quoted on the Bonitas web page. They also have a (short) history of calling out a couple of Australian companies that actually failed. Certainly, there’s some trading action that suggests some shareholders are concerned. But are these regular folk like me or are they there to be part of the action of those activists?

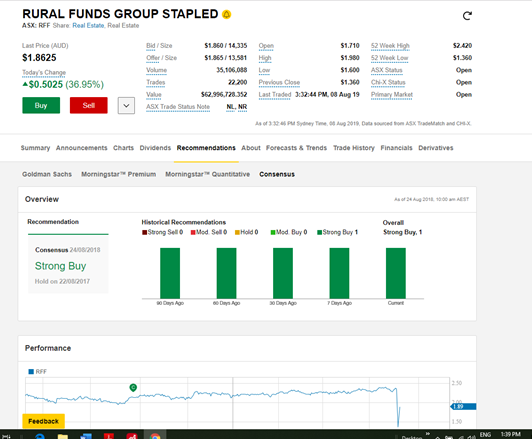

Taking a look at the research section on my bank brokerage platform I see Morningstar has RFF a STRONG BUY recommendation. That seems to have been the case for some time. No red flags there. A quick check of the trading depth reveals it is very small numbers. So, although the price plummeted it has the appearance of an orchestration more than widespread panic.

By now the rebuttals have started appearing and before the end of the day I have an invite to a webinar next morning from the managing entity. Do I sleep well –oddly I do! I learned early on that I love to gamble as long as it is within limits. This amount is pushing the envelope a little on what I define as money I can afford to lose, but it won’t put me on the streets. This is such an important thing to understand about your own mindset. What level of risk are you comfortable with? How much of the stock market rollercoaster can you handle?

Thursday :

I manage to get out of bed early enough to listen to the webinar. I’m in Perth so everything that happens in Sydney early morning is before I’m usually coherent. The webinar tone hardly reflects panic, more a measured and standard assurance. There will be an independent audit done and specific responses to the allegations in three weeks. About the time the annual financials were going to be released in fact.

By Thursday afternoon a good part of the value has been restored, the price is still down around 15% so that annoying red colour is still at the bottom of our portfolio. Three weeks to the audit result and counting down…….stay tuned.

(time passes….)

It has been 3 weeks with an extra edge of nervousness each time I have logged on. Now the report has been produced and loaded up for all to see. It effectively and quite thoroughly refutes the claims of Bonitas and has (oddly) been received with very little price reaction. Despite advice from one stock checking service that we belong to, to reduce our exposure, we have held on. Some of the fear was allayed when one of the Directors bought a very large number of shares.

A definite positive today is the notice that one of the largest investment fund managers in Japan has become a substantial shareholder. I’m thinking they may have slightly better analytical skills than I do 😊

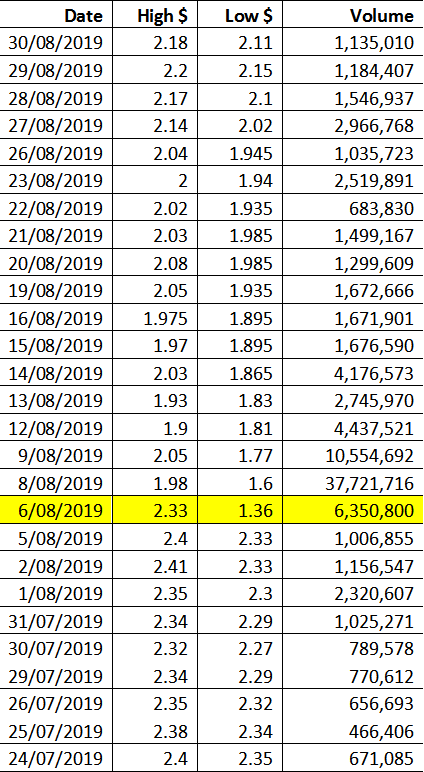

This is an excerpt from the trading history – showing how many shares have been traded daily in RFF. Fascinating I think, the day after the initial drama 37 million shares were traded at prices between $1.60 and $1.98. In a company where a normal trading day would see under 600,000 share change hands. With the price now over $2 there are a bunch of people laughing all the way to the bank. And a bunch who sold in those early days crying over their losses.

I hope you enjoyed reading about this little episode in stock trading. It seems to have had a happy ending for me although I’m sure not everyone feels that way. If you thought, as I did that a REIT would be less volatile, perhaps knowing that’s not necessarily the case might be handy. If you’re keen to jump on the stock market rollercoaster, ask yourself if you’re ready for the ride.

Happy trading!

What comes next?

Download our Free Financial Resources

Find the right Money School Course for you

Get the Book: Money School, Become Financially Independent and Reclaim Your Life, Lacey Filipich

Got a question: Contact Us

Lacey Filipich is the co-founder and director of Money School. She helps parents raise financially savvy kids and helps adults get on top of their finances. Connect with her on LinkedIn and follow the Money School Facebook page to learn more.