If you’ve read anything about Money School, you’d know we wouldn’t be here without Fran, the mother half of the our mother-daughter team.

Fran’s a bit shy. She’s more than happy to be in the background. Getting in front of a camera was a daunting task for her, but with a little coaxing we got there. It’s a shame she’s shy because Fran’s is the more inspirational story in our opinion. Starting investing at 48 years old and now a self-funded retiree, her life proves it’s never too late to start.

We’ve finally convinced her to tell more of her story. Here it is, in her own words:

A bit of my story

Suddenly, at the age of 40, I found myself a “single parent” with two little girls to look after. The expectation of being a family of four and sharing that life and all that responsibility with the father of my children gone.

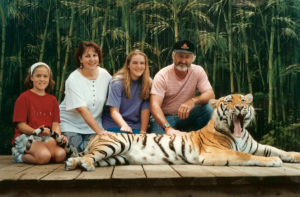

The ‘nuclear’ family – before we blew up 😉

If you’ve been there or known someone in that situation, you’ll relate to my recollection of the next ten or so years as often feeling like that mouse in the circular treadmill! I can say for sure that I never gave two minutes thought to funding my retirement, juggling money to survive those years was enough of a financial challenge. I chose to work part time so that I was always available to take the girls to school and pick them up, they occasionally went to the Vacation Care facility that I helped establish as I didn’t have family close by to help out during school holidays, but essentially I willingly and happily shelved the idea of a career and took a part time job that paid the bills (just!)

During those years, compulsory superannuation came in, starting at 3% in 1992. I think about $500 a year went into my fund at first so it wasn’t anything to get excited about. I thought it was a great idea and probably expected the size of the fund to grow much faster than it did. We were used to high interest rates and significant returns on any savings and really were not thinking about that changing as dramatically as it did. The bank rate in 1979 when we bought the first house was over 10%, in 1990 when we separated it was at its record high of 17.5%, it gradually sank to around 6% in 2000 when I bought the last house I owned in The Gap (Brisbane) and of course now it is under 2%.

Being a Baby Boomer, owning a home was important, so I took my half of the proceeds of the sale of the house we owned and bought a much cheaper house by myself, with a manageable mortgage. Turns out this was a really good decision because there were some years of big property value gains and if I had not stayed in the property market, the likelihood of getting back in later on a single salary would have been slim.

As we made the transition from Primary School years to Senior School years I worked more hours, and I thank my lucky stars that I had a boss who was prepared to be flexible as I would often leave work at 2.45, pick the girls up from school, take them to Mitchelton Youth Club (MYC) where they did gymnastics & judo, then go back to work until 5.30, then hit the road again to pick them up. We didn’t spend a lot of time at home and my mother would lament on her occasional visits that we always ate in the car going from one place to the next! We say life is busy these days, I think we redefined busy back then.

Starting in shares

Somewhere along the way, Suncorp issued notes that paid pretty good interest, and converted to shares after a period of time and my Dad asked me to take a look at the offer as bank interest was going down. Dad wasn’t into investing at all, his risk tolerance with money was around a minus 50…. but the offer looked good to me and he and I both invested in it. I somehow managed to find about $1,000, at the time a lot of money for me. Quite life changing, I think, looking back, the investment went well, from $4 a unit to $20 in about 5 years and paid good interest and then good dividends as well. I’ve still got Suncorp shares and I think of them as family (all the investing bibles will tell you the worst possible thing you can do is feel attached to your investments, but there you go, you don’t always have to do as the experts tell you)

Over the years I’ve sold them when they went up, bought them when they went down, sold call options against them and had those expire and sometimes get exercised, I’ve always re-invested the dividends with the scheme available and they have provided me with passive income and franked dividends so I’ve never had to come up with extra tax at the end of the year. So I don’t think being attached to them is a bad thing at all. Best of all they introduced me to an extended financial world, beyond wages and mortgages.

Starting in property investing

I don’t know if I would have ever made the transition into property investment without an event which was, at the time, a dreadful drama. I had bought into a house with my partner of several years and then we separated and sold the house. I contracted to buy another house by myself and then my ex-partner refused to sign the final release on the money unless I gave him more than the 50% he was entitled to. He knew I needed the money cleared desperately to pay for the new house and decided to basically rip me off! I refused and had to get bridging finance on the new house, back then the interest rates were not under 5%, so it cost me dearly.

After a couple of months, karma kicked in and he called me – a vehicle had rolled over on him at work out near Cloncurry and he was laid up in bed with his leg badly injured, then there had been heavy rain and all his possessions had been soaked and a lot ruined. He took the Universe’s hint and signed the papers 🙂

My partner with me and the kids, before taking the universe’s hint…

So the result of that was that instead of putting all the money I got from that sale into the new house, I kept a larger mortgage which was still manageable now that I was working full time, and had some cash to look for other investments. I bought some more shares and a couple of years later bought an apartment for my younger daughter and her boyfriend to rent. A year and a half later they wanted a house instead of a little apartment, so I bought a house which they rented instead of the flat.

By then it was just me and my partner at home, we were working hard as is common at that stage of your life – the kids move out and we go “wow empty nest!” Then we tie ourselves into more demanding jobs and fortunately, higher income to go with it. I kept buying shares, reinvesting the dividends always as I didn’t need the money to survive. Together we bought the place we still intend to retire to in Maleny (Sunshine Coast hinterland) and rented it out, it is still there 10 years later waiting for us, tenanted and positively geared now. It and the other properties gave me good negative gearing in those all-too-few years of high income.

Making mistakes

Then, just before the GFC we made the worst financial decision ever (in good crystal clear hindsight). We bought some blocks of land off an amazing sounding development in Victoria, it was going to become a wonderful place to live – ecologically sustainable with beautiful houses and common facilities like a resident owned market garden. Within days of us signing the contracts, the GFC hit and that plan kind of slid into the GFC abyss. Every cost blew out and the delay getting the estate launched was years. We are both optimists though so we hung on unlike so many others who sold out at huge losses, and amazingly there is now a house on one of the blocks, tenanted, and positively geared, and the value of the other land has finally climbed over the cost price.

With my family and my current partner – fortunately our mistakes haven’t been fatal!

I got into a few other things along the way – arbitrage, a horse racing betting scheme, options trading in the USA, forex trading – all of which I hoped would make me affluent beyond my wildest dreams. That journey is probably worth another blog at some time. The base of what now supports me remained and still is the property and the shares. It grew slowly and I have to confess, without any master strategy in my mind. I didn’t research where to buy very much, I bought in areas I knew and liked and I bought mostly blue-chip shares.

The role of superannuation

I’d better mention superannuation, although it wasn’t a game changer for me – typically of the gender inequality reality I was always paid a lot less than men doing the same job, and I worked part time for a lot of the period that superannuation existed. As I have already mentioned, it started at only 3% in 1992, and the funds were tied to the issues we’ve had in the world economy since then. When I retired just a few years ago I had the stunning sum of nearly $100,000 to sustain me for the rest of my life. It was reality of that cartoon which is captioned “I’m going to retire and live on my superannuation, I’m not sure what I’ll do the second day”. Now hopefully that will change for the next generations with the much higher SGC requirements, but the low interest rates will have a huge effect on the growth of those funds.

Lessons I’ve learned

I know that conditions are vastly different now, and in fact the economy has changed enormously during my lifetime. Doing the same things I did would likely have a different outcome over the next 15 years. However, I think there are a couple of simple lessons I’d present from my experience:

Firstly, you have to start by getting beyond MONEY IN = MONEY OUT, take some of the MONEY IN and INVEST it somewhere.

Secondly, PATIENCE is important, accept the fact that property investment will likely be a long term plan, don’t bail out after three years because it hasn’t reached the seven-year target.

Thirdly, learn the difference between GOOD DEBT and BAD DEBT (Money School can help you with this one, it is not the same definition anyone else uses)

Lastly, DIVERSIFY, don’t expect every choice you make to work out. It is probable that you’ll make a mistake or two along the way. Learn from them and buffer yourself by never having all your eggs in one basket.

I really do wish you all a fantastic financial future 🙂

What comes next?

Download our Free Financial Resources

Find the right Money School Course for you

Get the Book: Money School, Become Financially Independent and Reclaim Your Life, Lacey Filipich

Got a question: Contact Us

Lacey Filipich is the co-founder and director of Money School. She helps parents raise financially savvy kids and helps adults get on top of their finances. Connect with her on LinkedIn and follow the Money School Facebook page to learn more.